11:29:25

11:29:25  2023-11-28

2023-11-28  1468

1468

1- Pay off any outstanding loans. If you have any debt at all, pay it off as soon as you can. You cannot afford to be in debt if you're making minimum wage or less.

2- Look into banking alternatives. Some banks charge fees if you don't have a minimum amount in your account. This can make it difficult to save money. However, there are banking alternatives that may help you get on your feet.

3- Start a budget. Without a budget it can be hard to keep track of your expenses. You're more likely to overspend, and less likely to set aside money for savings.

4- Shop for used goods. There is no reason to buy everything new. If you have a little extra money, it can be tempting to splurge and treat yourself to something nice. However, if you do this too often, you run the risk of creating bad spending habits. If you can find it used, take that route and save yourself some money.

5- Find ways to pay for health insurance. Health insurance is not always affordable, but there are ways to get coverage if you are living in poverty. Maintaining your health is important, especially if you are living in poverty. People living in poverty are more susceptible to health problems, and medical bills can be devastating.

6- Save your change. Starting a change jar isn't going to make you rich overnight, but it will help you save small amounts that you can add to your savings account.

7- Learn to barter. You can barter for goods or services. If you have a particular skill set that you feel comfortable advertising, try using it to barter for things you need.

8- Save as much as you can. You may not have a lot of extra money if you're making minimum wage. Even with a second job, most of your money is probably going towards paying bills, or paying down your debt. Still, if you have any extra money at all, put it aside.

Reality Of Islam |

|

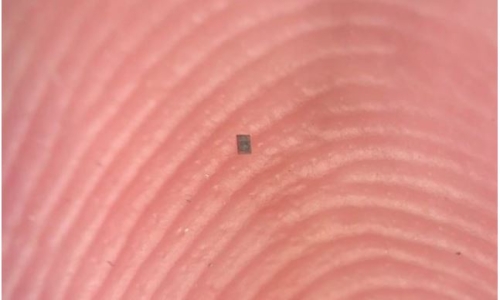

A tiny robo

By applying

Stanford, C

A new study

9:3:43

9:3:43

2018-11-05

2018-11-05

10 benefits of Marriage in Islam

7:5:22

7:5:22

2019-04-08

2019-04-08

benefits of reciting surat yunus, hud &

9:45:7

9:45:7

2018-12-24

2018-12-24

advantages & disadvantages of divorce

11:35:12

11:35:12

2018-06-10

2018-06-10

6:0:51

6:0:51

2018-10-16

2018-10-16

10:55:53

10:55:53

2022-06-13

2022-06-13

8:30:23

8:30:23

2022-03-03

2022-03-03

7:34:7

7:34:7

2023-02-28

2023-02-28

7:6:7

7:6:7

2022-03-21

2022-03-21

7:59:14

7:59:14

2018-06-21

2018-06-21

a hero waters thirsty wild animals

9:4:9

9:4:9

2022-01-06

2022-01-06

10:35:40

10:35:40

2022-05-26

2022-05-26

5:41:46

5:41:46

2023-03-18

2023-03-18

| LATEST |