10:13:15

10:13:15  2023-11-14

2023-11-14  1196

1196

Set up a budget that’s realistic and will allow you to follow it consistently. Make a budget that can absorb the unexpected. A budget is a work in progress. Your financial situation will constantly change and if your budget has the flexibility to accommodate plenty of variables you can save, pay off debt and invest to make your money grow.

2- Reduce credit card debt. Credit cards place you at one remove from your purchases. The process insulates you from your spending because you’re using a card (and not money) and don't have concrete "proof" that you're actually spending money. Credit card debt can accumulate quickly.

3- Grow your money by investing wisely. You can use your budget surplus to invest. Invest regularly over time in a diversity of places.

Reality Of Islam |

|

As air frye

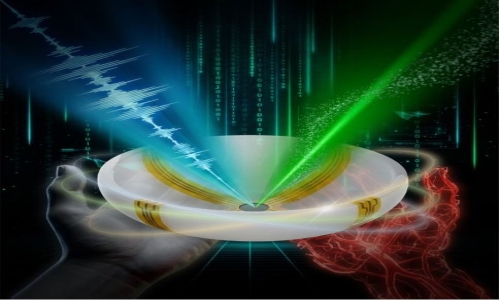

A newly dev

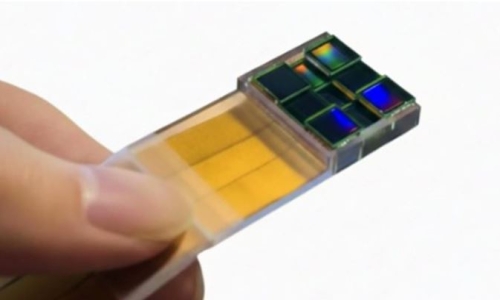

A new lens-

9:3:43

9:3:43

2018-11-05

2018-11-05

10 benefits of Marriage in Islam

7:5:22

7:5:22

2019-04-08

2019-04-08

benefits of reciting surat yunus, hud &

9:45:7

9:45:7

2018-12-24

2018-12-24

advantages & disadvantages of divorce

11:35:12

11:35:12

2018-06-10

2018-06-10

6:0:51

6:0:51

2018-10-16

2018-10-16

1:16:44

1:16:44

2018-05-14

2018-05-14

2:5:14

2:5:14

2023-01-28

2023-01-28

3:42:22

3:42:22

2021-12-24

2021-12-24

10:35:40

10:35:40

2022-05-26

2022-05-26

7:26:19

7:26:19

2022-04-08

2022-04-08

7:34:7

7:34:7

2023-02-28

2023-02-28

2:34:48

2:34:48

2022-01-18

2022-01-18

5:41:46

5:41:46

2023-03-18

2023-03-18

| LATEST |