1:14:4

1:14:4  2023-11-04

2023-11-04  1409

1409

1- Start an emergency fund. If you are living paycheck to paycheck and you lose your job during an economic collapse, you are at risk for losing your home and living in poverty. It won’t be easy to find another job and replace your income. Your goal should be to save up enough to cover six months of expenses in your emergency fund.

2- Have cash on hand. Depending on where you have it, money in your emergency fund might be hard to liquidate. Bonds, for example, must be sold, and other investments like CD’s might charge fees for early withdrawal. Also, if you have a savings account with an online bank instead of a brick-and-mortar institution, it might take several days to withdraw your money. It’s important to have cash that you can access easily, either from a savings account or a cash box in your home. This can tide you over in an emergency until you can access money in your emergency fund.

3- Generate an additional source of income. Start a home business as a second source of income. If you lose your job because of an economic collapse, it might be difficult or even impossible to find another job. Having an alternative source of income can help you to keep your home and avoid poverty. Choose your business idea based on skills that you have and things that you enjoy doing. In addition, think about how likely it will be that people will require these services in an economic collapse; people may need basic necessities like clean water or food more than they need an interior decorator.

4- Get out of debt. In a financial collapse, many people are going to lose their jobs and their homes. To prepare for this possibility, you should make a plan to get out of debt as quickly as possible. This way, if you do lose your job, you don’t have to worry about finding a way to pay these bills. The worst kind of debt to have is credit card debt. Because of the high interest rates that many people have, carrying a balance on a credit card can cost you a great deal of money.

Reality Of Islam |

|

As air frye

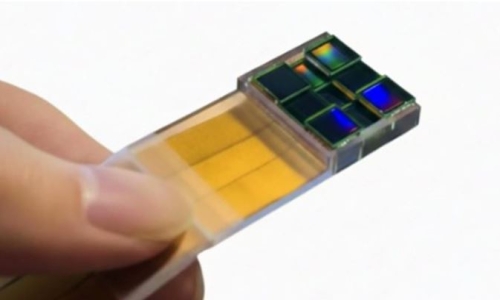

A newly dev

A new lens-

9:3:43

9:3:43

2018-11-05

2018-11-05

10 benefits of Marriage in Islam

7:5:22

7:5:22

2019-04-08

2019-04-08

benefits of reciting surat yunus, hud &

9:45:7

9:45:7

2018-12-24

2018-12-24

advantages & disadvantages of divorce

11:35:12

11:35:12

2018-06-10

2018-06-10

6:0:51

6:0:51

2018-10-16

2018-10-16

8:30:23

8:30:23

2022-03-03

2022-03-03

9:42:16

9:42:16

2022-10-19

2022-10-19

4:2:19

4:2:19

2022-10-10

2022-10-10

8:3:0

8:3:0

2018-06-21

2018-06-21

12:10:56

12:10:56

2022-11-17

2022-11-17

7:45:39

7:45:39

2018-06-21

2018-06-21

a hero waters thirsty wild animals

9:4:9

9:4:9

2022-01-06

2022-01-06

5:41:46

5:41:46

2023-03-18

2023-03-18

| LATEST |